There is widespread concern about a ‘crisis’ in the affordability of housing in the UK, and particular concern about rising rents in the Private Rented Sector (PRS). However, there is currently little consensus about what is actually meant by ‘affordability’ and what makes housing ‘affordable’. There have even been calls in recent weeks to abandon the concept of affordability as it has become less and less useful in discussions about the real difficulties faced by many households in meeting their housing needs. In order to assess and ultimately address the ‘problem’ of housing affordability, there needs to be a clear, agreed definition of what is ‘affordable’, and to whom.

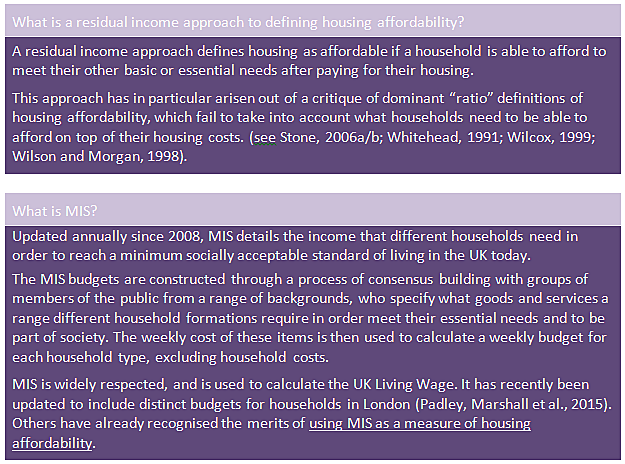

The paper I presented at the ENHR conference last month proposed a residual income approach to defining and measuring housing affordability, based on the Minimum Income Standard (MIS), and used data from the latest Family Resources Survey to examine the state of housing affordability in the UK PRS.

Put simply, the approach we are proposing says that housing is affordable to a given household if they can afford to pay for their housing and have enough left over to cover what is needed to reach the MIS budget for their household type. However, some households have incomes so limited that they would be below MIS even if they were to pay no housing costs. We therefore set about operationalising a measure of housing affordability that takes into account whether households are below MIS because of their high housing costs rather than because they have a low income.

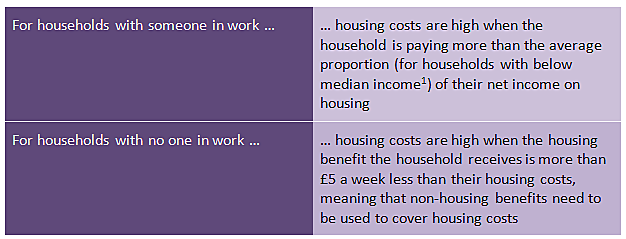

Our working definition states that housing is unaffordable if a household has “high” housing costs and a residual income below MIS – that is, what is left is insufficient for a given household to reach MIS. High housing costs are defined differently for households with and without work.

The analysis I presented applied these two definitions, and the 2013/14 MIS budgets, to the Family Resources Survey data for 2013/14, to determine the number of households in the PRS with high housing costs and with residual incomes below MIS.

One in five households in the UK PRS has unaffordable housing

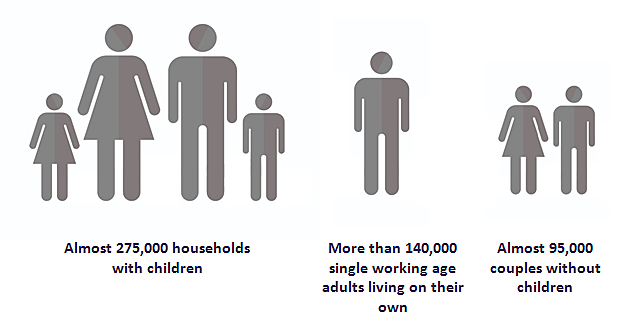

The analysis revealed that at least one in five households in the UK PRS have unaffordable housing – which means that they have high housing costs and after paying their rent have insufficient income left over to afford a minimum acceptable standard of living.

Our initial analysis shows that households with children are particularly likely to have a housing affordability problem: 27 per cent of privately renting households with children in London, and 30 per cent of these same households outside of London have both high housing costs and residual incomes below MIS. In London, single working age adults without children are also at greater risk of having an affordability problem. A quarter of single working age adults living on their own in the PRS in London have high housing costs and residual incomes below MIS, compared to just one in ten couples without children in the capital, and less than one in five single adults outside of London.

This preliminary analysis shows the potential for a measure of housing affordability that takes into account both the proportion of income a household spends on housing, and their ability to afford a minimum, decent standard of living after paying for that housing. This new measure could be used for a variety of purposes beyond indicating the extent of the housing affordability problem, including assessing the (potential) impact of different policies. As an illustration of this, the paper I presented at the ENHR conference looked at what impact a proposed “Living Rent” model, entailing capping private rents at 30% of median local income, could have on the housing affordability problem in the PRS. The analysis found that such a Living Rent would lift almost 57,000 households across the UK out of their affordability problem, and would mean that approximately 33,000 households who previously had residual incomes below MIS would have sufficient income to afford a minimum acceptable standard of living.

Our analysis, then, indicates the scale of the housing affordability “problem” for private renters in the UK, but also reflects the complex nature of this problem. Policy needs not only to address problems off affordability in the PRS but also wider problems in the housing market. A Living Rent, for example, is not the only way in which these problems will be solved. House building, increased security of tenure and a cultural change from houses as investments to houses as homes are also needed. More research is also needed to understand the complexities of housing affordability and the impact of housing costs on households’ ability to afford a minimum acceptable standard of living. Our ongoing analysis seeks to contribute to this conversation in coming months.

Acknowledgements

This paper was based on ongoing analysis being undertaken by Lydia Marshall (NatCen) and Matt Padley (Centre for Research in Social Policy). The analysis arose out of the “A Minimum Income Standard for London” programme of work, funded by Trust for London. Acknowledgements also go to the Housing Studies Association, for awarding Lydia Marshall a bursary to present this paper at the ENHR 2016 conference.

References

Padley, M., Marshall, L., Hirsch, D., Davis, A. and Valadez, L. (2015) A Minimum Income Standard for London. London: Trust for London.

Stone, M.E. (2006a) “What is Housing Affordability? The case for the residual income approach” Housing Policy Debate 17(1): 151-184.

Stone, M.E. (2006b) “A Housing Affordability Standard for the UK” Housing Studies 21(4): 436-476.

Whitehead, C. (1991) “From Need to Affordability: An Analysis of UK Housing Objectives” Urban Studies 28(6): 871–87.

Wilcox, S. (1999) The Vexed Question of Affordability. Edinburgh, Scotland: Scottish Homes.

Wilcox, S. and Pawson, H. (2011) UK Housing Review 2010/11 Coventry: Chartered Institute of Housing.

Wilson, W. and Morgan, B. (1998) “Rent Levels, Affordability, and Housing Benefit” Research Paper 98/69 London: House of Commons Library.

[1] This median is calculated separately for households in London and for households in the rest of the UK.